Sales and use tax computation

Sale amount 1295 the tax rate 625. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

How Is Tax Liability Calculated Common Tax Questions Answered

Sales tax is a combination of occupation taxes that are imposed on retailers receipts and use taxes that are imposed on amounts paid.

. In transactions where sales. Floridas general state sales tax rate is 6 with the following exceptions. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

The sales tax is comprised of two parts a state portion and a local. How o Calculae and Pay Esmaed Sales and Use Tax. This is an increase of 18 of 1 percent on the sale of all tangible personal property that.

View the Sales Tax Rate Chart 79-106 Local Option Sales Tax In addition to the state sales tax. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. Measure reported Measure reported Measure found Compliance ratio Provided the taxpayers use tax.

General Tax Adminisraon Program. Effective January 1 2020 the Clark County sales and use tax rate increased to 8375. The rate is 6.

Sales Use Taxes information registration support. The 6 percent tax rate is applied to a portion of the sale of new mobile homes and modular buildings as well as a portion of the gross receipts from vending machine sales. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

State Sales and Use Tax The state sales tax and use tax rates are the same. Local taxing jurisdictions cities counties special. TaxCloud offers sales tax calculation for any address in the United States as well as registration filing remittance detailed reporting and audit response services.

Hit enter to return to the slide. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Easily manage tax compliance for the most complex states product types and scenarios.

725 Tax Rate Chart. Ad Accurately file and remit the sales tax you collect in all jurisdictions. The use tax is a back stop for sales tax and generally applies to property purchased outside the state for storage use or consumption within the state.

The Nebraska state sales and use tax rate is 55 055. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the. Ad New State Sales Tax Registration.

Sales and use tax system. For use in Storey county from 112001 through 6302009 Churchill county from 1012005 through 6302009 and Washoe county until 6302003. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022.

Virginia Tax will continue to compute the use tax compliance ratio as follows. How to Calculate and Pay Estimated Sales and Use Tax. The third decimal place is greater than four so the tax would be rounded up to the next cent and would.

The tax calculation would be 0809375. The term sales tax actually refers to several tax acts.

An Exclusive Solution For All Your Tax Filing Needs Features That Help You Make Tax Filing 100 Accurately Spect Filing Taxes Income Tax Return Tax Software

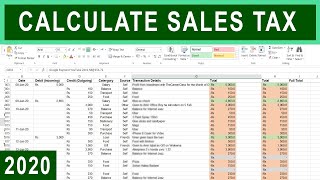

How To Calculate Sales Tax In Excel

Sales Tax Calculator

As Per The Changed Rules Notified Under Section 234f Of The Income Tax Act Which Came Into Effect From April 1 2017 Income Tax Filing Taxes Income Tax Return

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Accounting Cost Of Goods

How To Calculate California Sales Tax 11 Steps With Pictures

How To Calculate Sales Tax In Excel

Excel Formula Two Tier Sales Tax Calculation Exceljet

Advanced Money Word Problems Digital Cards Boom Learning Distance Learning Money Word Problems Word Problems Understanding Word Problems

How To Calculate Sales Tax In Excel Tutorial Youtube

Money Task Cards Making Change Adding Tax Percent Of Sale Adding Tip Task Cards Money Task Cards Math Task Cards

Effective Tax Rate Formula Calculator Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

Small Business Tax Deductions Small Business Tax Business Tax Deductions

Spectrum Is Designed To Fully Automate The Process Of Tax Computation And Return Preparation Save A Lot More O Tax Software How To Apply Chartered Accountant

Income Tax Computation Format Pdf Simple Guidance For You In Income Tax Computation Format P Tax Forms Income Tax Income

Excel Formula Income Tax Bracket Calculation Exceljet